A cozy suite with stunning views, seamlessly blending functionality and style

- from 150,000

- Interior 35 m2

- 1 Bed

- 1 Bathroom

- Elegant seating area

- from 184,000

- Interior 40,5 m2

- 1 Bed

- 1 Bathroom

- Compact versatile kitchen island and Panoramic windows of 2.8m height

Bright and airy apartments with large windows that fill the space with natural light

- 278,000

- Interior 62,7 m2

- 1 Studio bedroom

- 1 Bathroom

- Terrace 8,8 m2 and Balcony 4 m2 (on the ground and first floor)

- 379,500

- Interior 117,75 m2

- 2 Bedrooms

- 2 Bathrooms

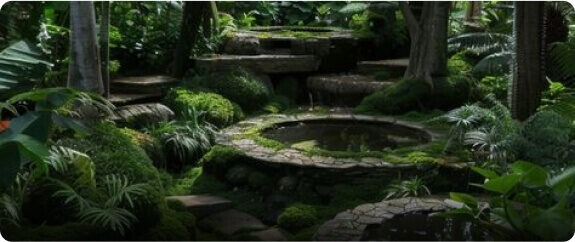

- Garden area 34,5-46 m2 and Terrace 9 m2

- I have access to exclusive offers and closed pre-sales

- I will calculate for you the true profitability and payback period for a specific project

- I will provide real assistance in legal matters with contracts and document verification

- I will agree with the developer on the maximum installment plan and discount

proximity to nature and infrastructure

income in a stable currency

increase in the value of real estate

Considering the tourist load of Bali, the projected income from renting out a villa will be from 10 to 12% annually.

We are talking about net income, from which taxes on rental income and the management company commission have already been deducted.

To receive income, you do not need to open a company or obtain a license.

You will receive your dividends anywhere in the world quarterly along with accounting data.

When purchasing a villa from a developer at the construction stage, a convenient installment plan is possible. The payment plan is negotiated individually with the developer.

As a rule, the initial payment is 30%, the remaining amount is paid in stages as construction progresses

The process begins with choosing a property and checking the ownership rights.

This is followed by signing a preliminary contract, paying a deposit and finally drawing up the main purchase and sale contract with registration of the ownership rights.

Cash on arrival

Payment by bank transfer

Payment by cryptocurrency

In most cases, USDT is used for payment.

Under Indonesian law, a foreign resident cannot acquire property.

A foreigner may own real estate under leasehold agreement long-term lease.

It is a notarial contract, which has legal effect and is concluded by a notary. For the term of the lease you are the full owner and can resell it.

Ownership of real estate under this contract is absolutely safe. Leasehold term is up to 31 years with the possibility of extension for 25 years.

At the end of the lease period, which is 56 years in total, the new period is reviewed without any restrictions.

All lease extension negotiations are conducted by the management company.

11% VAT

1% Notary fee

VAT and notary fees are paid by the buyer, and the profit tax is paid by the developer.

When buying a property in installments, VAT is proportionally included in the payments under the property purchase agreement.

Notary fee is paid when concluding the main lease agreement with a notary. After payment, you become the full owner with an entry in the official land register.

Ownership of land and building is subject to PBB (Pajak Bumi dan Bungunan) tax.

The tax is calculated based on the basic rates (NJOP) of the cost per square meter of land and the property approved by local government agencies. These rates vary for different regions. The total cost of the land and building based on the basic rates is multiplied by 0.2%. This is the amount of the annual tax.

10% tax on rental income and the sale of real estate.